Building and enhancing your net worth is crucial for financial stability and long-term success. Whether you’re just starting out or seeking to optimize your existing financial situation, there are several effective strategies to consider. This article outlines the top strategies and tips to help you boost your net worth, similar to how Mellstroy’s net worth demonstrates the impact of effective financial management.

Understand Your Net Worth

What is Net Worth?

Net worth is the difference between your total assets and your total liabilities. To calculate your net worth, list all your assets (such as savings, investments, and property) and subtract your liabilities (such as debts and loans).

Why is it Important?

Understanding your net worth helps you gauge your financial health, set realistic goals, and track progress over time.

Create a Comprehensive Budget

Why Budgeting Matters

A well-crafted budget helps you manage your finances, track spending, and allocate funds towards savings and investments. It ensures you live within your means and avoid unnecessary debt.

Budgeting Tips

- Use budgeting tools or apps to simplify tracking.

- Categorize your expenses and set limits for each category.

- Regularly review and adjust your budget as needed.

Build an Emergency Fund

Purpose of an Emergency Fund

An emergency fund provides a financial cushion for unexpected expenses such as medical emergencies or job loss. It prevents you from relying on credit cards or loans during tough times.

How Much to Save

Aim for three to six months’ worth of living expenses. Store this fund in a readily accessible savings account.

Pay Down High-Interest Debt

Impact of High-Interest Debt

High-interest debt, like credit card balances, can drain your finances and hinder wealth-building efforts. Prioritizing debt repayment is crucial for financial health.

Debt Repayment Strategies

- Debt Snowball Method: Focus on paying off the smallest debt first, then move to the next.

- Debt Avalanche Method: Pay off the debt with the highest interest rate first.

Invest in Retirement Accounts

Benefits of Retirement Accounts

Contributing to retirement accounts like 401(k)s or IRAs offers tax advantages and helps ensure financial security in retirement.

Maximize Contributions

- Take full advantage of employer match programs.

- Contribute up to the annual limit set by the IRS.

Diversify Your Investments

Importance of Diversification

Diversification spreads your investments across various asset classes to manage risk and enhance potential returns. It helps protect your portfolio from market volatility.

Investment Options

- Stocks and Bonds: Consider a mix of equities and fixed-income securities.

- Real Estate: Invest in rental properties or real estate investment trusts (REITs).

- Mutual Funds and ETFs: Invest in diversified funds to gain exposure to a broad range of assets.

Explore Real Estate Opportunities

Real Estate as an Investment

Real estate can offer appreciation and passive income. Options include buying rental properties, flipping houses, or investing in REITs.

Considerations

- Research local markets thoroughly.

- Evaluate potential returns and associated risks.

Increase Your Earning Potential

Strategies for Income Growth

Enhancing your skills and qualifications can lead to higher earnings. Additionally, consider side hustles or freelance work to supplement your primary income.

Action Steps

- Pursue additional training or certifications.

- Explore career advancement opportunities.

- Develop secondary income streams such as consulting or online businesses.

Make Smart Tax Decisions

Tax Planning Benefits

Effective tax planning can save you money and boost your net worth. Understanding tax deductions and credits helps you minimize your tax liability.

Tax Tips

- Keep detailed records of all deductions.

- Consult with a tax professional to optimize your tax strategy.

Monitor and Adjust Your Financial Plan

Regular Review

Financial situations and goals can change over time. Regularly reviewing and adjusting your financial plan helps ensure you stay on track.

Adjustment Tips

- Reassess your budget and investments periodically.

- Make necessary adjustments based on changes in income, expenses, or financial goals.

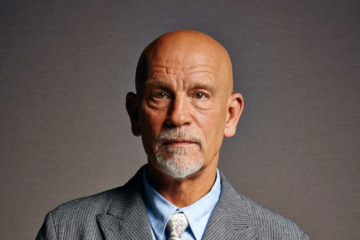

Mellstroy Net Worth

Mellstroy, whose real name is Andrey Burim, is a notable figure in the digital entertainment space, particularly recognized for his live streaming and controversial online presence. As of 2024, Mellstroy’s net worth is estimated to be substantial, reflecting his success in the online world. His financial achievements are a result of his diverse income streams, including live streaming revenue, sponsorships, and digital content creation.

Mellstroy’s financial strategy exemplifies several of the tips outlined above. For instance, his success highlights the importance of leveraging multiple income sources and investing wisely. By diversifying his income and managing his finances effectively, Mellstroy has built a considerable net worth, demonstrating the potential of these financial strategies in action.

FAQs

1. What is the best way to start boosting my net worth?

Start by creating a comprehensive budget, building an emergency fund, and paying down high-interest debt. These steps lay a strong foundation for financial growth.

2. How much should I aim to save in an emergency fund?

Aim to save three to six months’ worth of living expenses in an easily accessible savings account.

3. How can I diversify my investments effectively?

Diversify by investing in various asset classes, such as stocks, bonds, real estate, and mutual funds. This helps manage risk and improve potential returns.

4. What are some good ways to increase my earning potential?

Enhance your skills through education and training, seek career advancement opportunities, and explore additional income streams like side hustles or freelance work.

5. Why is tax planning important for boosting net worth?

Effective tax planning helps you reduce your tax liability, allowing you to retain more of your income for savings and investments.

Conclusion

Boosting your net worth requires a combination of disciplined financial management, strategic investments, and ongoing adjustments. By implementing these top strategies and tips, you can enhance your financial stability and work towards achieving your long-term financial goals. Mellstroy’s financial success serves as an illustrative example of how these principles can be applied effectively to build and maintain substantial net worth. Remember, consistency and proactive management are key to building and maintaining a strong net worth.

Keep an eye for more news & updates on Gossips!