Increasing the possibilities of good returns with easy professional fund management has increased investments in mutual funds. However, when investment is made at different intervals, the calculation of return on mutual fund investment becomes tough. It is here that XIRR makes a difference. XIRR is the investment return calculator used for calculating return on investments whose cash flow is irregular. It becomes very handy for the mutual fund investor who invested at different times and withdrew some of it, too.. This blog will tell you How to Calculate XIRR for Mutual Fund Investments

What is XIRR?

XIRR means Extended Internal Rate of Return. It is the measure used in determining annua returns from investments made with cash flows at irregular intervals. This is not standard IRR, as cash flows are spread evenly under that assumption. XIRR considers the date for every single cash flow, and this makes it a much more accurate measure of return.

For example, take SIP where you invest on different dates every month, thus not uniform cash flows. XIRR takes the same into account while making a more accurate computation for the rate of return in your mutual fund investment.

Why Use XIRR for Mutual Fund Investments?

In mutual funds, investments and redemptions don’t always occur at fixed intervals. Investors might add funds at irregular times, redeem part of the investment, or receive dividends on specific dates. XIRR helps by providing an annualized rate of return that factors in these irregular cash flows, offering a true picture of investment performance.

Key reasons to use XIRR for mutual fund investments include:

- Accounting for Irregular Contributions: In a mutual fund, the contributions are made at irregular times, which affects the computation of returns.

- Accurate Performance Tracking: It can track the actual performance of a portfolio by considering every investment and withdrawal’s timing.

- Annualized Return: XIRR is an annualized return, giving a comparable figure that fits with other financial metrics.

Steps to Calculate XIRR for Mutual Funds

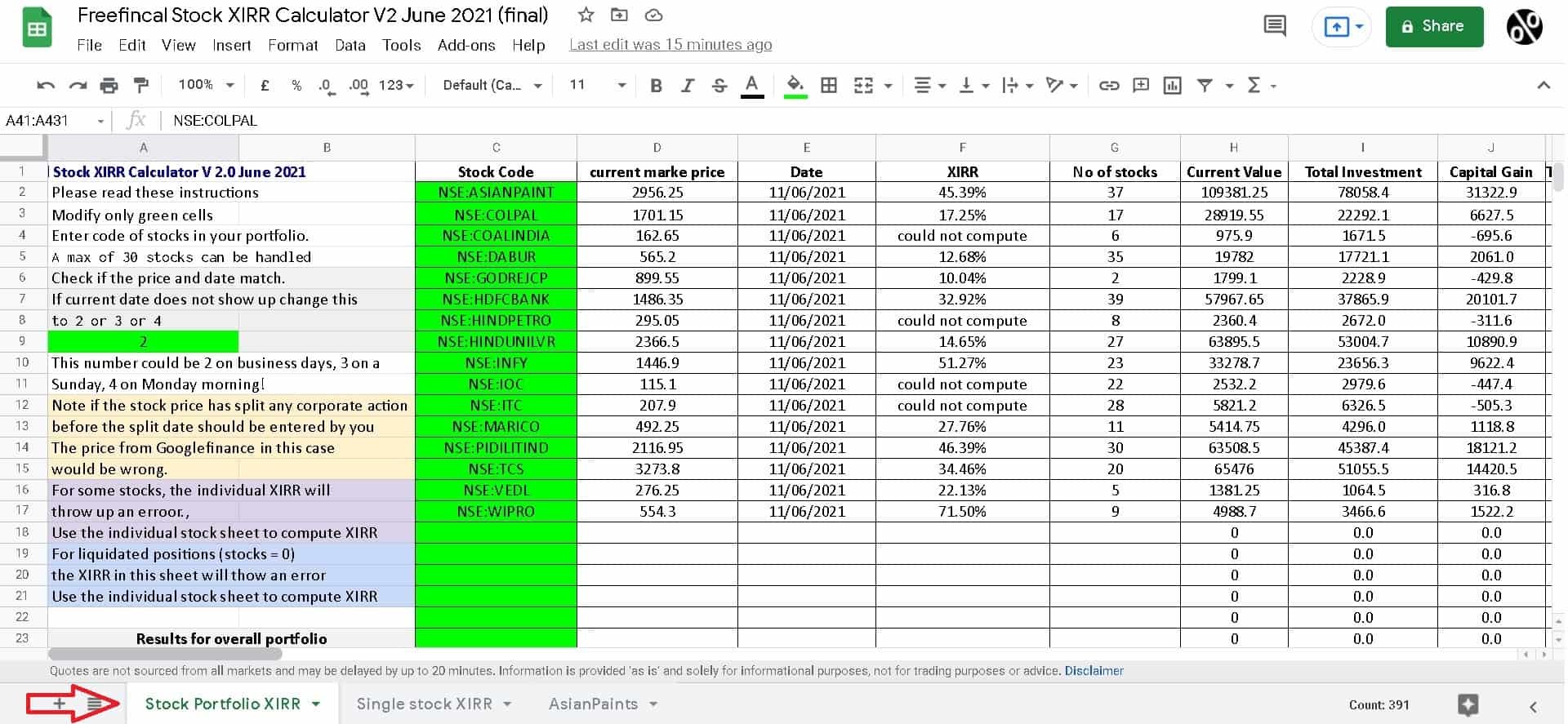

One has to compute XIRR on a record of all the investment or withdrawal and dates, after which these numbers are then used in the spreadsheet or financial software. Let’s walk through it by working through example steps of how to calculate XIRR using Excel, probably one of the most common tools an investor will encounter.

Step 1: Gather All Transaction Data

- First, you have to list all transactions. This includes every investment, redemption, and dividend, should they be reinvested. Every transaction must contain the following two key facts:

- Amount: The amount of investment (mentioned as a positive number) or withdrawn (mentioned as a negative number).

- Date: The dates of the transaction.

For example, suppose you put money into a mutual fund on the following dates.

- 01 January, 2023: $1,000

- 01 March, 2023: $1,500

- 01 June, 2023: $2,000

- 01 September, 2023: $2,500

- Final value on 31December, 2023: $8,000 (redemption value or current portfolio value if you are still holding it)

Step 2: Organize Data in a Spreadsheet

Open a spreadsheet. Insert the following columns: Date, Transaction Amount, Notes (optional, for reference).

Initial investment date in the date column and amount in transaction amount column in the first row. Then put each investment and redemptive on new lines, along with the appropriate dates.

Place a negative number in the final row, representing the redemption value of the portfolio. Again, date this to be the date you wish to calculate the XIRR; it is the date when you are cashing out of your investment. Though you have not sold any units of the mutual fund, you are doing a cash-out.

Here is an example:

| Date | Transaction Amount | Notes |

| 01-Jan-2023 | 1000 | Initial Investment |

| 01-Mar-2023 | 1500 | Additional Investment |

| 01-Jun-2023 | 2000 | Additional Investment |

| 01-Sep-2023 | 2500 | Additional Investment |

| 31-Dec-2023 | -8000 | Redemption / Final Value |

Step 3: Apply the XIRR Formula in Excel

An even more accessible function in MS Excel for calculating internal rate of return with non-uniformly staggered cash flows is the built-in “XIRR” function. Once your data is properly organized, carry out the following:

- Select a cell where you want the XIRR result to appear.

- Enter the formula: =XIRR(values, dates)

- Values: The range of cells containing the transaction amounts (e.g., B2:B6).

- Dates: The range of cells containing the transaction dates (e.g., A2:A6).

In our example, you would enter:

=XIRR(B2:B6, A2:A6)

- Press Enter. Excel will output the XIRR value, which represents the annualized rate of return for the specified period.

The result you get from the XIRR function will be a decimal. You can multiply it by 100 to express it as a percentage. For example, if Excel returns 0.1245, your XIRR is 12.45%.

Example Calculation

Let’s say Excel returns a result of 0.1245. Multiplying by 100 gives you an annualized XIRR of 12.45%. This rate reflects the annualized return on your mutual fund investment, accounting for all contributions and the exact timing of each cash flow.

Tips for Calculating XIRR Accurately

- Enter Cash Flows Correctly: Make sure to enter each cash flow accurately, including investments as positive numbers and redemptions or withdrawals as negative numbers.

- Use the Final Value: If you haven’t sold the mutual fund units, use the current portfolio value on the calculation date as the final cash flow (negative value).

- Verify Dates: Ensure that the dates correspond exactly to each cash flow to maintain precision in the calculation.

Interpret the results of XIRR

The XIRR you will calculate is the CAGR of your mutual fund investment, which is an absolute measure to compare your returns with other investment options. The higher the XIRR, the better the return; however, remember that XIRR is historical and no guarantee of future performance.

Conclusion

XIRR is one very important metric mutual fund investors use for a pretty accurate return calculation for when the cash flows do not appear regularly. For an investment with an irregular timing for every cash flow, XIRR will provide the accurate annualized rate of return for such investments. A person understanding XIRR would greatly enhance their analyses over their investments and more confidently make decisions. However, whether you are doing regular investments through an SIP or irregular amounts, XIRR will give a very realistic perspective of how your portfolio has performed.

Keep an eye for more latest news & updates on Gossips!