Investing is a powerful avenue for building wealth over time, yet the vast array of options and strategies can make it overwhelming. Having a clear investment blueprint is essential to navigate this landscape effectively. This article outlines fundamental concepts, key strategies, and practical tips to help you grow your financial portfolio.

Understanding the Basics of Investing

Before diving into specific investment strategies, it’s vital to grasp the basic concepts of investing. At its core, investing involves allocating your money to assets with the expectation of generating a return over time. Unlike saving, where funds remain stagnant in a bank account, investing allows your money to grow through compounding returns. Compounding means earning returns not only on your initial investment but also on the interest or gains previously accrued. This powerful effect can significantly enhance your wealth in the long run.

Staying Informed and Educated

The financial landscape is constantly changing, making it essential for investors to stay informed. Regular education about market trends, economic indicators, investment strategies, and the commodity market is crucial for successful investing.

Consider subscribing to financial news outlets, podcasts, or online courses that cover both traditional and alternative investments, including commodities. Joining investment clubs or online forums can also provide valuable opportunities to share experiences, ask questions, and learn from others, particularly regarding the dynamics of the commodity market and its role in a diversified portfolio.

Diversifying Your Portfolio

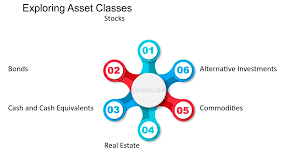

Diversification is a crucial strategy for enhancing your financial portfolio. By spreading investments across various asset classes, you can mitigate the impact of underperformance in any single investment.

- Asset Allocation: This involves distributing your investments among different asset classes—such as stocks, bonds, and real estate—according to your risk tolerance and investment goals. Many investors opt for mutual funds for their inherent diversification, providing exposure to multiple securities in a single investment.

- Sector Diversification: Investing in various sectors of the economy, such as technology, healthcare, and consumer goods, can protect your portfolio against downturns specific to any one sector.

- Geographic Diversification: Expanding your investments internationally allows you to tap into different economic conditions and growth opportunities, including those in emerging markets or the commodity sector.

Setting Clear Financial Goals

A foundational step in any investment blueprint is setting clear financial goals. Reflect on what you hope to achieve with your investments, including how much you intend to invest in mutual funds. By defining specific targets for your mutual fund investments, you can better align your strategy with your overall financial objectives.

When defining financial goals, consider the following:

- Specificity: Clearly articulate your investment objectives.

- Measurability: Ensure that your goals are quantifiable, allowing you to track progress.

- Achievability: Set realistic targets based on your current financial situation and future income potential.

- Relevance: Align your investment goals with your broader life objectives, ensuring they contribute to your overall aspirations.

Understanding Risk and Return

Every investment involves a degree of risk, and understanding the relationship between risk and return is crucial for informed decision-making.

Assess your risk tolerance by considering factors such as your age, financial situation, and investment objectives. Younger investors may be more willing to accept risks for the potential of higher returns, while those closer to retirement often prioritize capital preservation.

To manage risk effectively, consider the following strategies:

- Regularly Rebalance Your Portfolio: This process ensures that your asset allocation remains aligned with your risk tolerance and investment goals.

- Invest in Index Funds: These funds offer a cost-effective way to achieve diversification by tracking specific market indices, thus reducing the risks associated with individual stocks or bonds.

Developing a Long-Term Mindset

Investing should be viewed as a long-term commitment rather than a short-term endeavor. Developing a long-term mindset is essential for achieving financial goals, especially in the face of inevitable market fluctuations.

To cultivate this mindset, keep the following tips in mind:

- Focus on the Big Picture: Regularly review your financial goals and assess your progress to maintain perspective.

- Avoid Market Timing: Attempting to predict market movements can lead to missed opportunities and losses. Instead, focus on consistent investing over time to benefit from compounding returns.

Conclusion

Creating a successful investment blueprint involves understanding the fundamentals of investing, setting clear financial goals, diversifying your portfolio, and maintaining a long-term perspective. By staying informed and disciplined, you can effectively navigate the complexities of investing and work toward growing your financial portfolio.Whether you decide to invest in mutual funds or explore opportunities in the commodity market, remember that investing is a journey, not merely a destination. Embrace the process, learn from your experiences, and watch your wealth grow over time. With these guiding principles, you can build a solid foundation for your financial future.

Stay in touch to get more news & updates on Gossips.Blog!